What the Hell Is Happening With Crypto? Part 1

The incredibly successful SBF was shown to be highly incompetent guy caught in a web of drugs, free sex and a whole host of financial crimes.

Up until a little over a year ago, Crypto was a sort of Eldorado of the investing markets. A brave new world, where the financial power was taken away from the state and big corporations, and given back to the individual investor.

As can be seen in this weekly Bitcoin chart below (that I'm using as proxy for the entire market), starting December 2021, the prices started cratering.

In February 22, 2022, with BTC valued down from 68k to 37k, I wrote an article called Crypto Wars, in which I talked about the regulatory risks that became associated with Crypto due to Joe Biden's hellish economic policies.

'But there's another war that is going on behind the scenes - one that may prove to have a big impact in the future: The Crypto War. Maybe we can call it a 'Coinflict'.

It unfolds against a background of rising inflation and the insane printing and debasing of the American dollar, as well as other fiat national currencies.

It also takes place during unprecedented assaults on human liberty, sometimes to the point of societal breakdown.'

I also noted in this article how Russia and Ukraine, at the brink of war, were both committed to accepting cryptocurrencies and incorporating them into the war effort - and that will have some repercussions in this story.

As I write, BTC is trading around a little under 17k, and no one is surprised by that - for recently, the FTX scandal and bankruptcy exposed the underbelly of the once-exciting market of the cryptocurrencies.

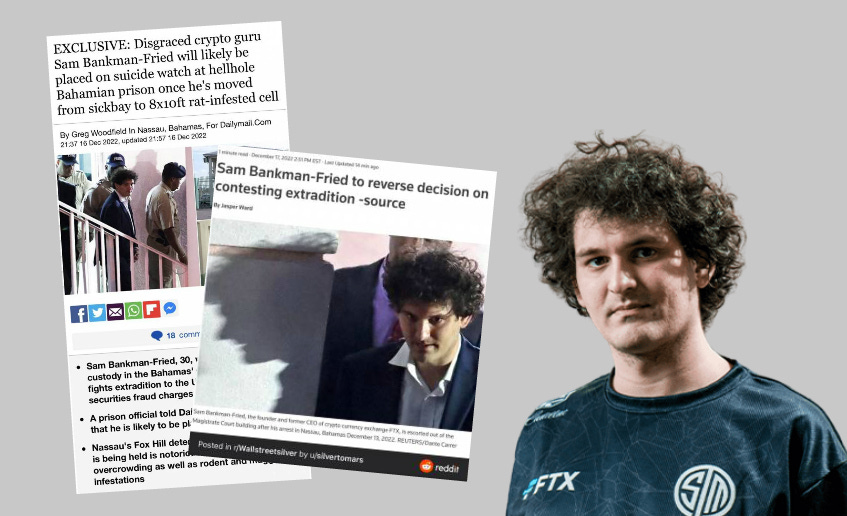

It also introduced many - I am one of those - to 'the shambolic 30-year-old former multibillionaire' Sam Bankman-Fried. The 'Crypto bro', who was always a darling of the DNC media, is now called 'scammy', 'crypto crook', 'fraudster'.

The incredibly successful SBF was shown to be highly incompetent guy caught in a web of drugs, free sex and a whole host of financial crimes.

He is no joke, though. Bankman-Fried is the second-biggest donor to the Democrats, after George Soros.'

To begin with, the FTX scandal showed openly how CD swamp launders Ukraine 'aid. The taxpayer funds were sent as 'aid' to Ukraine. They were subsequently 'invested' by Zelensky's goons in FTX funds. The now-insolvent company (scam?) proceeded to make huge political donations to politicians and PACs - mostly Democrats, but also establishment Republicans.

Money laundering out in the open, done by the same people, mind you, who were supposed to scrutinize the 'aid' being sent to Ukraine in the first place.

November 2nd, 2022 was the day in which Sam Bankman-Fried’s cryptocurrency empire began to unravel before our eyes. His enterprises could be divided into two main parts: FTX, the third-biggest crypto exchange in the world, and trading giant Alameda Research.

But news outlet Coindesk came out with a report that sparked alarming rumors about the solvency of his companies. They examined leaked balance sheets from Alameda, and found: 'That balance sheet is full of FTX – specifically, the FTT token.'

That was concerning news, because 'Alameda rests on a foundation largely made up of a coin that a sister company invented, not an independent asset like a fiat currency or another crypto.'

This sent shockwaves across the financial world.

“It’s fascinating to see that the majority of the net equity in the Alameda business is actually FTX’s own centrally controlled and printed-out-of-thin-air token.” Cory Klippsten, CEO of investment, platform Swan Bitcoin.

From then, things started moving pretty fest. Changpeng Zhao, CEO of Binance, the world's largest crypto exchange, announced he was getting rid of all his FTT. The FTX token lost 80% of its value, wiping out more than $2 billion in a day.

A 'bank run' started, and FTX was illiquid to honor the requested withdrawals by its clients.

A solution was quickly patched up: FTX was to 'merge' with Binance (be acquired) to address the “liquidity crunch.” A tentative contract was reached, pending due diligence discovery.

That hope lasted only 24 hours. Binance put out this statement on the following day:

'As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com.

In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help.'

Meanwhile, the investors and the general public was finding out loads of distressing information about the fallen SBF empire and the 'untraditional makeup of his inner circle.'

FTX's crypto empire was reportedly run by a bunch of roommates in the Bahamas who dated each other

Coindesk reported that '[t]he whole operation was run by a gang of kids in the Bahamas. Both [FTX and Alameda] were run by Bankman-Fried's inner circle of 10 roommates. All of them either are — or have been — paired up in romantic relationships with one another.'

'It's a place full of conflicts of interest, nepotism and lack of oversight', the source told CoinDesk.

+++

Even the richest man in the world felt compelled to give is 'two cents' on the issue. Elon Musk took to his Twitter to tell of his meeting with disgraced Bankman-Fried.

'Not many beans to spill. I had a conversation [with] FTX in May. He [SBF] was clearly on stimulants. He kept talking about himself and FTX.'

Musk did not mince words: 'My bull shit meter was red-lining. Deep insight wasn’t necessary. He talked about himself and not about transactions. The bullshit factor was high.'

On the subject of stimulants: according to reports, an in-house psychiatrist was always on hand on the crypto bros luxury penthouse to dole out prescription stimulants.

A crypto reporter flew to the Bahamas to try to interview SBF, and found what is said to be his Toyota Corolla, with pills inside.

+++

Bankman-Fried was ousted as CEO for FTX and replaced by John J. Ray III, a corporate restructuring lawyer who oversaw the liquidation of Enron.

'Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here [...] this situation is unprecedented.'

New York Times: the exchange owes as much as $8 billion.

FTX's records: Alameda Research lent $1 billion to Bankman-Fried and more than $500 million to FTX co-founder Nishad Singh as of 30 September.

December 12: Bankman-Fried is arrested in the Bahamas at the request of the U.S. government, mere hours before his Zoom testimony before House Financial Services Committee Waters’ hearing that was bound to embarrass Democrat leaders.

Bankman-Fried is, after all, the second-biggest donor to the Democrats.

New York Post: 'He helped bankroll Joe Biden into the White House and had promised to donate $1 billion to help the party win the 2024 presidential election. […]

There are those, such as Elon Musk, who allege that SBF, as he is called, already has funneled $1 billion of stolen customer funds to Dem causes via various dark money PACs. Others on Wall Street put the number lower, at maybe $500 million.'

Former prosecutor Andy McCarthy, on Fox News: 'The Democrats who run the Justice Department accommodate the Democrats who run the committee.'

A few days later, as he unveiled charges against SBF, U.S. Attorney Damian Williams called it 'one of the biggest financial frauds in American history.'

End of Part 1

In part 2: Sex, drugs and fraud: the level of crazy is compounded. SBF deported and released on bail | Caroline Ellison pleads guilty | 3 Crypto CEO's death in a month.

Great article Paul! I love how you are exposing the the money laundering. So many people don't have a clue as to what is happening with our tax dollars.

Loose end